Rich dad always says “You should not work for money. To become rich, money should work for you“. Though this line looks simple, when you understand the meaning behind it, you will be financially successful in life. Read Rich Dad, Poor Dad book to understand how to make money work for you.

People are losing a lot of money when they use the credit card without proper planning. The sad part is, most of the people using credit cards are not aware of what they are losing in the name of interest rates and penalties. We are living in an age where carrying a credit card is a social status. I’m not opposing the credit card usage, I’m against people who buy things they don’t need and never pay their credit card bills on time.

Types of credit card users

Credit card usage is different for everyone and we can divide them into 3 types based on how they spend and repay the debts. See which category you belong to.

Type 1: Clears full debt on time

These type of people use their cards with proper planning, buy things which they actually need and repay the entire debt on the due date. If you fall into this category, appreciate yourself. You are doing really good. Banks hate these people because they are not falling in their trap. Yes, banks can not make any profit from this category of people since they pay full debt on time. Banks can not charge any interest or penalties and hence banks don’t make any money.

Also Read: Top Coupon Sites to Save Money while Making Online Purchase

In fact, this is beneficial for customers. Let me explain how:

Consider you need to buy a high-end MacBook Pro with touch bar which costs you Rs. 2,00,000. If you properly plan and buy this product with the credit card on the first day of your statement cycle, then you have 30 days to repay it from your savings account and you will get extra bank interest

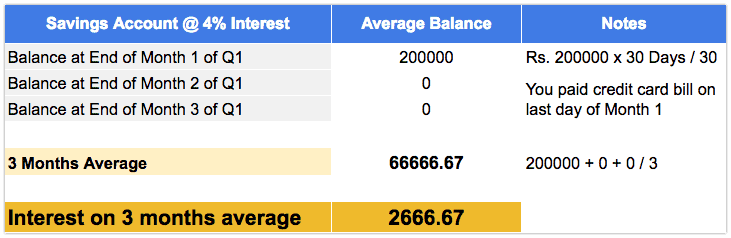

Let’s calculate the extra bank interest you get when:

- When the bank interest rate is 4%

- Assuming you already had enough amount of Rs. 2,00,000 in your savings account but still you made the purchase with credit card.

- Purchase made few hours after last credit card statement is generated.

- Repay the full Rs. 2,00,000 debt few hours before the due time.

Interest earned: Rs. 2,666

So you made Rs. 2666.67 by making an online purchase with a credit card (instead of the debit card) and pay the debt on time. Here you didn’t work for money. Instead, money worked for you. This is why financial planning is a game changer.

Note: Interest earned here is taxable and you should declare it in ITR and pay the taxes as per your income slab.

Type 2: Clears minimum due on time

Some people pay only minimum due on time and pay the remaining balance later. If you are doing this, you are trapped. Credit card companies intelligently lure you with minimum due where you can pay a very small amount of your total due. Generally, it is around 3-10% of actual total due. It sounds good and people fall for it. This is actually a great business move by credit card companies to make money.

Though you paid the minimum due on time, you have to pay the remaining balance with interest. This is where credit card companies start making money and they like you if you fall under this category.

Type 3: Never pays debt on time

People in this category swipe their credit cards everywhere and make online purchases for little luxuries. Not stopping here, they never care to pay debts on time. They skip a couple of months and pay 2 or 3 months bills in a single shot. If you can relate to this – STOP DOING IT!

Credit card companies love you from bottom of their heart since you are the one helping them in making huge profits. Interest rate on credit card late payments is too high. Depending on the bank you are using, it can be in double digits which is huge. And interest compounds every month.

Compounding money is powerful than you imagine. If you are compounding your debts, you are making serious financial mistakes and it costs you a lot both financially and mentally.

Is Personal Loan an Alternative?

The simple answer is IT DEPENDS.

Generally, interest rates on personal loans are low when compared with the interest rates of credit cards. You should use credit cards for short-term goals like 20-30 days. Personal loans are preferable during long-term investments like 6-9 months. Use credit cards only if you are sure you can repay the debts within 15-25 days. Failing so will make you fall in either Type 1 and Type 2 category and ultimately you pay hefty penalties and interest.

Should you take a personal loan to pay credit card debt?

Both credit cards and personal loans have their own advantages and disadvantages. You should by now understood when to use a credit card and when to take the personal loan. It all depends on the time you need to clear the debts.

Then what about existing debts?

If you are either Type 2 or Type 3 credit card user and had a lot of debts to clear, then you should immediately consider a personal loan to clear credit card bills immediately.

Instead of paying high interest on credit cards balance, just pay it using personal loan and pay a lower interest rate on the loan amount. In the end, you are saving money which is our ultimate goal.

But how can you get a personal loan with bad credit score?

Since you are delaying credit card payments from a long time, probably, you will have below average or bad credit score which makes it really hard to get a personal loan. But luckily PaySense provides loans quickly to people with low or zero credit history. It has a very minimal paperwork and provides door to door service. At the time of writing this article, PaySense had over one million Android app downloads with an average rating of 4.1 from 23500+ people. Over Rs. 180 crores have been distributed as loan amount to 11 lakh customers. Looks like PaySense is one for you to clear the existing debts with the low-interest rate.

Once you clear the debts, make sure you stay in Type 1 category people and only purchase what you NEED. Plan your money properly and reach financial freedom as soon as possible. Always remember, You should never work for money; MONEY SHOULD WORK FOR YOU.

Leave a Reply